non filing of income tax return consequences

There is a certain penalty for late filing of income tax return. If the return income is not filed and the notice from tax department has been received then there will be a penalty in.

For How Many Previous Years A Taxpayer Can File Income Tax Return Income Tax Return Income Tax Tax Return

Individuals filing income tax returns beyond the due date have to pay these penalties.

. Consequences of non-filing of Income Tax Return. 3 rows Hence even if your income falls under basic exemption limit you might be under the list of. Here are the consequences of not filing ITR.

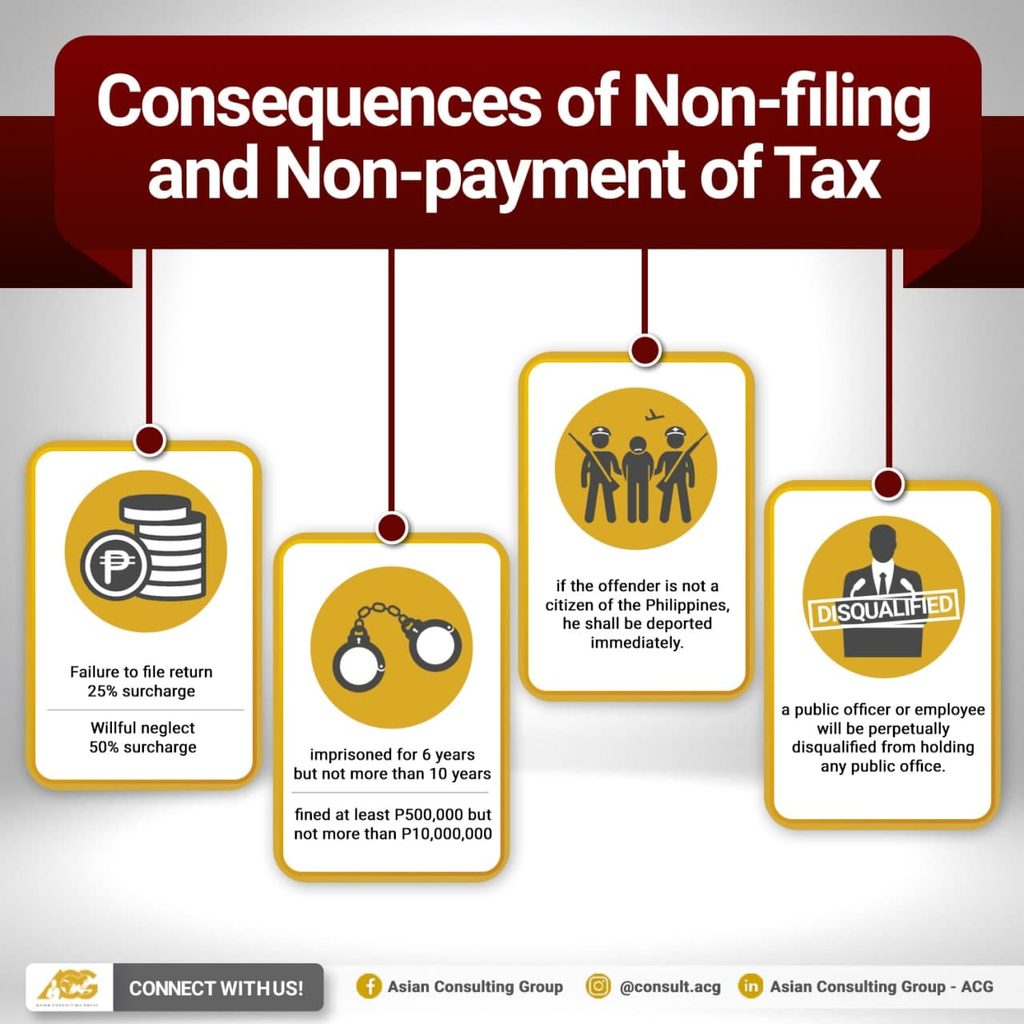

Income Tax Return ITR filing is an annual activity seen as a duty of every responsible citizen of the nation. Section 255 also imposes a compromise penalty of not less than P10000 and imprisonment of not less than 1 year but not more than 10. Well you end up paying a penalty on the amount you owe at 5 per month 45 for not filing and 05 for not paying.

Default in the furnishing of the. A penalty that is twice the amount of tax assessed. Consequences for non-filing of a tax return in India.

Thus Non-filing of Income Tax Return may result in the penalty of Rs. Consequences for non-filing of a tax return in India October 2018. Penalty under Section 234F.

Carry forward of Losses not allowed except in few exceptional cases. Due Date of Filing Income Tax Return for an NRI The due date of filing income tax return for the financial year 2012-13 is 31st July 2013. 4 rows 2Interest on delayednon filing of Income Tax Returns.

The specifics regarding imprisonment are as follows. The benefits and importance of doing so are enlisted below. From penalty to imprisonment.

As per section 234F a fine of Rs10000 will be levied for failing to file tax returns which is quite a heavy price to pay for an average person. If a person fails to furnish return before the end of the relevant assessment year the assessing officer may levy a penalty of Rs. Non- filing of income tax return leads to heavy penalties with interest us 234 A 234 B and 234 C accordingly.

The Income Tax Department of India has lowered the. For possible tax evasion exceeding Rs25 lakhs. Ad Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions.

If your gross total income before allowing any deductions under section 80C to 80U exceeds the basic exemption limits as prescribed by the Income Tax Department you have to mandatorily file your Income Tax Return for that Financial Year or Assessment Year. Penalty for not filing ITR plus imprisonment of at least 6 months which can extend to 7 years. If a company fails to file its Corporate Income Tax Returns for two or more years it may be issued with a summons to attend Court.

Thus Non-Filing of the Income Tax Return may result in the Best Judgement Assessment. The tax department levies heavy fines on individuals who do not file and pay their taxes. AO can issue notice us 142 1 if the return is not filed before the time allowed us 139 1.

But here we are discussing only the adverse consequences of Non-Filing of the Income Tax Return. 1 Penalty us 271F. New Powers of FBRDisabling of Mobile SimsDisconnection of Electricity MeterDisconnection of Gas Meters along with other penalties on non return filersSeek.

However following must be considered. Pay 0 to File all Federal Tax Returns Claim the credits you deserve. Losses such as business loss speculative or non-speculativecapital losslong term or short term and loss in race horse maintenance are not eligible to be carried forward as per section 80 of the IT Act.

Consequences of non-filing of tax returns Penalty and Interest. In case if tax payable is nil that is all tax has been deducted at source individual can still. Levy of interest penalty.

Income Tax Return ITR filing is an annual activity seen as a duty of every responsible citizen of the nation. Prescribed penalty plus imprisonment of at least 3. What are the consequences of non filing of Income Tax Return.

Interest compounded daily is also charged on any unpaid tax from the due date of the return. The total penalty for failure to file and pay can eventually add up to 475 225 late filing 25 late payment of the tax owed. The foremost impact of not filing ITR is a penal interest of 1 is charged us 234A of the Income Tax Act 1961 for default in payment of tax by the due date.

A person can claim the refund of the excess tax paiddeducted during a. Upon conviction the company may be ordered by the Court to pay. Failure to file Corporate Income Tax Returns for two or more years.

This is an assessment carried out as per the best judgment of the Assessing Officer on the basis of all relevant material he has gathered. As per the provisions of Indian domestic tax laws every entity including foreign entities in receipt of any income is required to file its Income- tax return in India. In case an assessee has taxable income but fails to file return of income the consequence may be sever especially if the motive of non-filing is tax evasion.

If any taxpayer is not filing hisher return on time. Late filing fee of Rs. The penal interest is charged in addition to the normal interest on tax.

To avoid a penalty. A fine of up to SGD1000. May lead to Best judgment assessment by the AO us 144.

Other than the above some additional implications become applicable if return is not filed by the due date. Owing to the lack of awareness or otherwise the Indian Government has observed that many entities. Income Tax Return Filing is one of the most important aspects of personal finance management.

The last date to file returns for the financial year is July 31st. If a person has not filed his income tax returns heshe will be issued notice us 142 1 for. The Supreme Court of India in its recent judgment Sasi Enterprises V Assistant Commissioner of Income Tax.

Therefore just keep in mind the above consequences of non filing of your Income Tax Return and start working on it. If you missed the due date here are some consequences of not filing an income tax return that NRIs may face. As per recent amendments in Section 234F of the IT Act taxpayers who file ITR after the deadline have to pay a maximum fine of Rs.

Penalty For Late Filing Of Income Tax Return For Ay 2020 21 Income Tax Return Income Tax Tax Return

Consequences Of Non Or Late Filing Of The Income Tax Return

Penalty For Late Filing Of Income Tax Return Ebizfiling

Consequences Of Not Filing Taxpayer Advocate Service

Irs Notice Cp515 Tax Return Not Filed H R Block

Income Tax Filing India Itr Filing Taxation Policy In India Filing Taxes Income Tax Income Tax Return

Ask The Tax Whiz Consequences Of Non Filing Non Payment Of Tax Returns

Income Tax Filing India Itr Filing Taxation Policy In India Filing Taxes Income Tax Income Tax Return

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Penalties For Claiming False Deductions Community Tax

Penalty For Late Filing Of Income Tax Return Income Tax Return Income Tax Tax Return

Attention Taxpayers Here Is What Happens When One Files The Itr Timely V S Those Who Fail To File Their Return By Due Tax Refund Income Tax Income Tax Return

Ay 2020 21 Income Tax Return Filing Tips Which Itr Form Should You File Income Tax Return Income Tax Return Filing Income Tax

You May Land Up In Jail For Non Filing Of Itr File Income Tax Business Reputation Filing

What Happens If Itr Is Not Filed What Are The Consequences

Consequences Of Delay In Filing Itr Non Payment Of Tax And Non Filing Of Income Tax Return Naveen Fintax Income Tax Return Income Tax Tax Return

Buying Property From Nri And Consequence Of Non Deduction Of Tax Buying Property Deduction Tax